The Binance Liquid Swap is a revenue system through which you will be able to generate passive income by adding your cryptocurrencies to a liquidity pool. Through Binance Liquid Swap you will be able not only to trade cryptocurrencies quickly, but also become a liquidity lender for currency pairs and earn a percentage of the transaction fees paid by traders. We have already written about other Binance Earn opportunities, such as Binance Launchpoll. To discover all the opportunities of Binance click here.

Liquid Swap is inspired by the principles of decentralized finance (DeFi) and makes this passive earning opportunity easy and accessible to anyone who has no experience with Dex. The Liquid Swap is an excellent alternative to simple cryptocurrency staking, which allows you to obtain good passive earnings. The payout percentages can vary due to a number of factors, such as the number of trades and the size of the pool. Polls with little liquidity will have higher percentages, which may decrease or increase based on the amount of liquidity.

Before starting to add liquidity to the various pools it is good to understand the concept of Impermanet Loss. Although in fact using the Liquid Swap is an activity that allows you to obtain a good return on investments, you can still face a loss caused by the volatility of the markets.

IMPERMANENT LOSS: WHAT IS IT?

An impermanet loss is a temporary loss that occurs when the value of the tokens changes from the time you deposited them into the pool. The loss means less dollar value than the value at the start of the deposit. The loss is defined impermanent because it only occurs in the event that the money is withdrawn. However, this loss can be offset by the gain earned from the cash loan. To avoid the risk of impermanet loss, you can lend liquidity to stable pools, for example to pairs of stablecoins which, not being subject to fluctuations, have a stable value over time and do not suffer the risk of impermanent loss.

HOW TO ADD LIQUIDITY TO A POOL

Adding liquidity to Binance’s Liquid Swap is very simple. First open the Finance menu and select Liquid Swap.

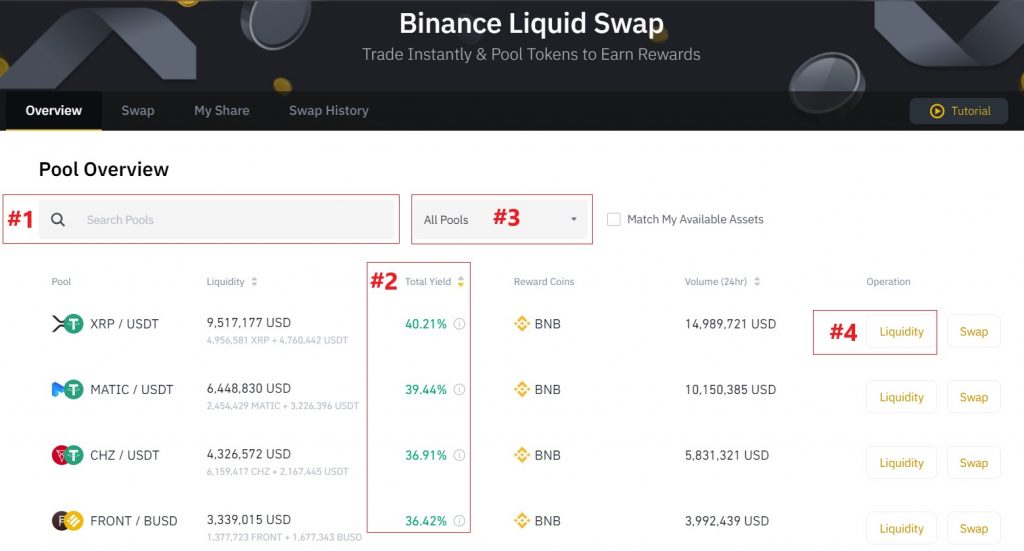

In the main screen you will find the whole list of active pools. Use the search form (1) to find specific pools. For each pool you will be able to view the liquidity of the pool, the volume of the last 24 hours and the TOTAL YIELD (2). A 40% Yield pool will allow you to get $40 for every $100 of investment on an annual basis. You can decide to withdraw money from the pool at any time. If you want to invest in stable pools without impermanent loss, open the drop-down menu (3) and select Stable Pool (the remuneration, however, is much lower). Select the pool you like and click on LIQUIDITY (4).

Once you have selected the currency pair to add liquidity to, add the amount of tokens you would like to invest. Binance will automatically calculate the equivalent of the other token to be added (you must have both tokens in your wallet). In our example we have selected the XRP / USDT pair, we have selected the maximum amount for XRP and automatically the equivalent in USDT comes out. Click on ADD LIQUIDITY to add liquidity.

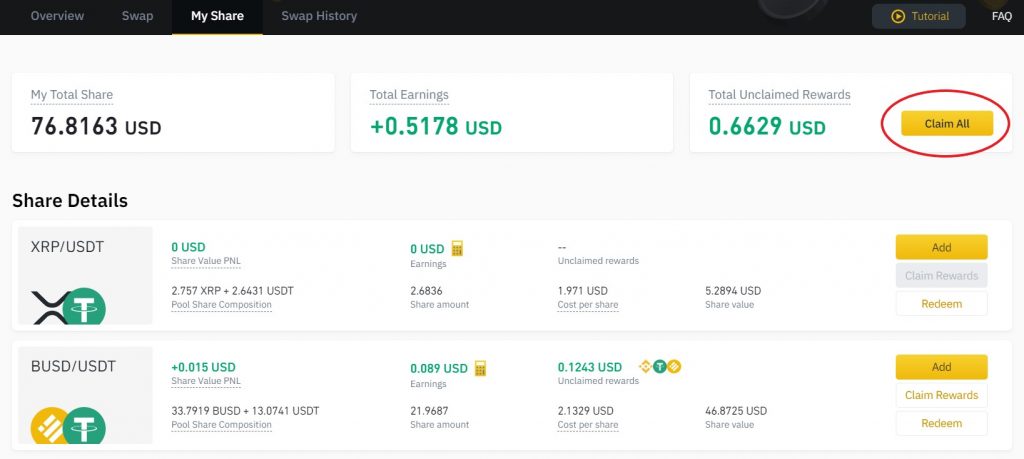

You will be able to view all your active shares on MY SHARE, from which you can also redeem the rewards from the various active pools by clicking on CLAIM REWARD or CLAIM ALL. You can withdraw your invested token at any time by clicking on REDEEM.

In conclusion, Binance Liquid Swap is an excellent solution for a passive gain. In the face of very high percentages, there is a small risk of temporary losses caused by the impermanent loss which can however be offset by the rewards. Providing liquidity to the pools is certainly a valid alternative to simple staking. The ideal is to differentiate between different pools, staking and other opportunities. For those are new to the DeFi world, Binance’s liquid swap is a good preparatory path to start understanding how DeFi works before moving to Decentralized Exchanges, which offer even higher percentages.